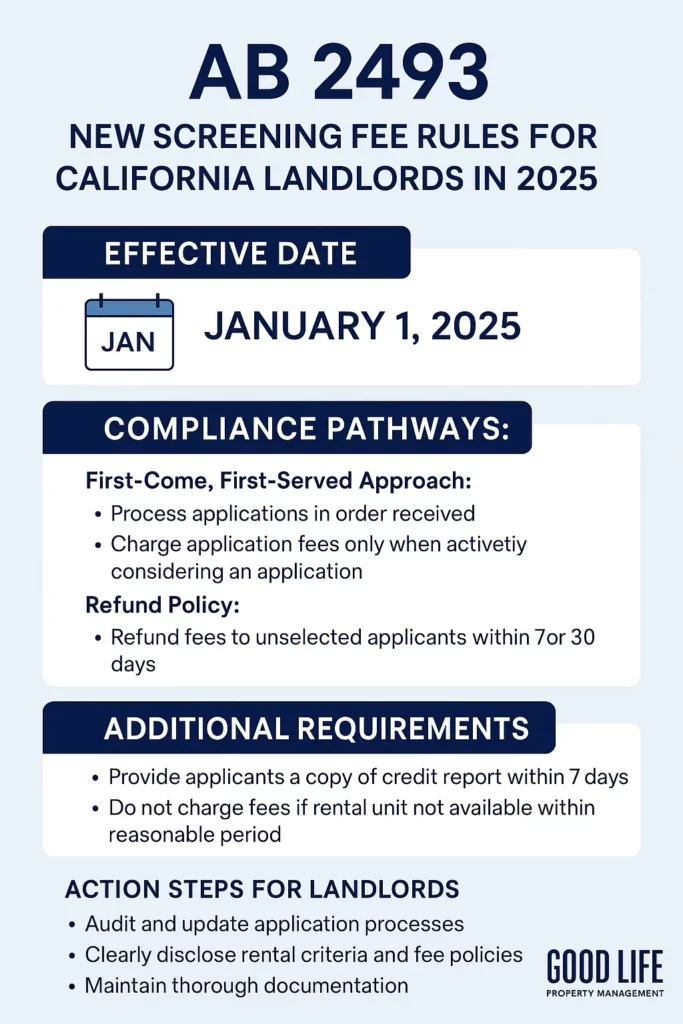

As of January 1, 2025, California’s AB 2493 is officially in effect, bringing significant changes to how landlords handle rental application fees and tenant screening processes. These new rules aim to improve transparency and fairness, but they also come with new responsibilities for housing providers. Understanding these updates is critical for landlords who want to avoid penalties and ensure their rental processes align with California’s regulations.

If you’re looking for experienced Orange County property managers who can simplify compliance with AB 2493 and protect your investment, give us a call at (949) 892-1505. We’ll help you navigate these changes and stay ahead. Whether you need an Irvine property management service, Anaheim rental property manager, or Huntington Beach property management expert, our team ensures you stay compliant while finding the best tenants for your rental. Contact us today to streamline your leasing process.

Key Takeaways

- AB 2493 requires landlords to process applications in the order they’re received or refund fees to unselected applicants.

- Rental criteria like income and credit score requirements must be shared with applicants upfront.

- If you charge application fees, you’ll need to refund them within 7 or 30 days, depending on the situation.

- Credit reports must be provided to applicants within 7 days, or 3 days if specifically requested.

- If you haven’t updated your processes yet, act now to avoid compliance issues.

Table of Contents

What You Need to Know About AB 2493

1. Two Compliance Pathways for Screening Fees

Under AB 2493, landlords must follow one of two structured pathways when handling rental application fees:

Option 1: First Come, First Qualified, First Approved

- Strict Order Processing: Applications must be processed in the order they’re received. Skipping or prioritizing certain applicants is prohibited.

- Written Rental Criteria: Landlords must provide clear, written rental requirements—such as credit score, income thresholds, and rental history—alongside the application form.

- Fair Evaluation: All applicants must be assessed based on documented criteria, reducing the risk of discrimination claims.

Option 2: Refundable Application Fees

- Refund Requirements: If application fees are charged, unselected applicants must be refunded within:

- 7 days of notifying the selected tenant, or

- 30 days of application submission, whichever comes first.

- Refunds for All: Refunds apply to all unselected applicants, whether they failed to meet criteria or withdrew voluntarily.

- Proof of Refunds: Keep records of refunds to verify compliance in audits or disputes.

Pro Tip: Evaluate which pathway works best for your rental business. Implement robust tracking and refund systems now to prepare for compliance.

2. Credit Report Requirements

AB 2493 also introduces timelines for sharing credit reports with applicants during the screening process:

- 7-Day Rule: Provide applicants with a copy of their credit report within 7 days of receipt.

- 3-Day Rule: If an applicant requests their report under the Investigative Consumer Reporting Agencies Act (ICRAA), deliver it within 3 days of the request.

Pro Tip: Partner with tenant screening vendors that can automate credit report delivery securely and ensure compliance with privacy laws.

3. Immediate Action Steps for Compliance

Now that AB 2493 is in effect, it’s critical to:

- Review Your Processes: Audit your application workflows and fee policies for compliance.

- Update Application Forms: Include clear rental criteria and fee disclosures in your forms.

- Choose a Compliance Pathway: Decide whether to adopt the “First Come, First Qualified” process or set up a refund system for application fees.

- Document Everything: Maintain records of application timestamps, rental criteria disclosures, and refund receipts for at least three years to avoid disputes or penalties.

For more tips, check out our tenant screening guide to streamline your processes.

We’re Here to Help With AB 2493 Compliance

At Good Life Property Management, we specialize in simplifying compliance for California landlords. From updating tenant screening processes to handling refund systems, we can help you navigate the complexities of AB 2493 with ease.

We service all of Orange County, ensuring landlords in every city receive expert support. Whether you need a Fullerton property manager, Costa Mesa property management company, or Newport Beach rental management expert, our team is here to help keep you ahead of legal changes. If you have questions about AB 2493 or need assistance managing your rental, schedule a call today.

Don’t forget to download our detailed guide to AB 2493 on this page: A Short Guide to AB 2493. It’s packed with insights to help you navigate the new rules with confidence.

FAQs About AB 2493

What does AB 2493 require landlords to do?

AB 2493 requires landlords to either process applications in the order they’re received or refund application fees to unselected applicants within specific timelines. It also mandates that credit reports be provided within 7 days of receipt or 3 days upon request.

What happens if landlords don’t comply with AB 2493?

Noncompliance can lead to penalties, legal disputes, and audits. Proper documentation and adherence to the law’s requirements are essential to avoid these issues.

Do landlords still need to provide rental criteria to applicants?

Yes, landlords must provide written rental criteria to every applicant alongside the application form. This ensures transparency and reduces the risk of discrimination claims.

How do I handle refunds under AB 2493?

Refunds must be issued to unselected applicants within:

- 7 days of notifying the selected tenant, or

- 30 days of receiving the application, whichever comes first.

Steve Welty

Subscribe to Our Orange County Landlord Newsletter

Get in touch with us:

Pro Services

Tired of headaches?

We got you covered.

Schedule a call with a

Property Management Expert

Here’s what you’ll learn from the call:

- How much your property will rent for

- How much property management will cost you

- How long it will take to rent your property

We connect your rental property with 50,000+ potential tenants to find the right fit fast.

Orange County Property Management Blogs

How Long Will It Take to Rent My Orange County Property?

Learn six proven strategies to help you reduce vacancy rates by renting your property to qualified tenants as fast as possible.

SB 602 Explained: Protect Your Property from Squatters

Ever wondered why the topic of squatter rights keeps trending in rental property discussions? It seems the idea of someone taking over your vacant property and living there legally for

SB 1051: Key Changes for California Landlords in 2025

Learn about SB 1051 and its impact on California landlords starting January 2025. Understand new obligations regarding lock changes and tenant protections.